Irs free tax calculator

The maximum an employee will pay in 2022 is 911400. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Tax Calculator Estimate Your Taxes And Refund For Free

Partner with Aprio to claim valuable RD tax credits with confidence.

. Or when done editing or. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The TCE program gives.

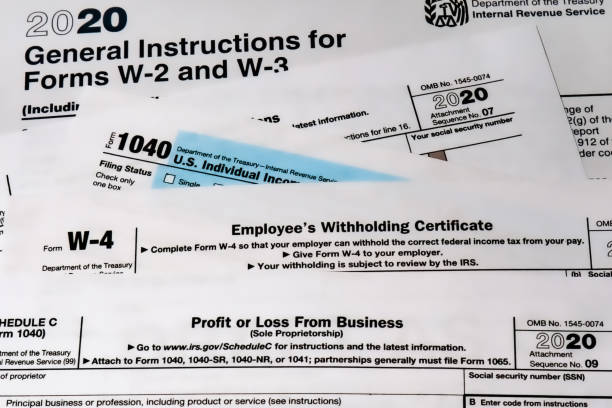

Free File Fillable Forms are electronic federal tax forms equivalent to a paper 1040 form. Estimate your tax return with our free 1040 tax calculator. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

If any of the following is true for your crypto activities youll qualify as a day trader. You need the Premier. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

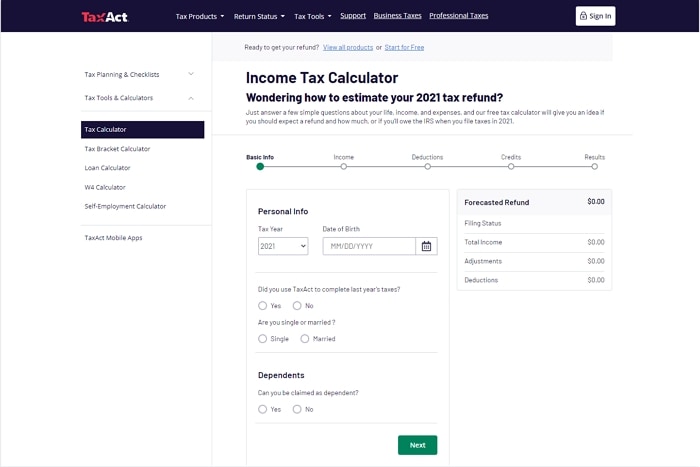

Based on your projected tax withholding for the year we can also estimate. Taxpayers whose AGI is 73000 or less qualify for a free federal tax return. TaxAct is another simple and easy to use online tax calculator that allows you calculate how much tax refund you will get or conversely how much.

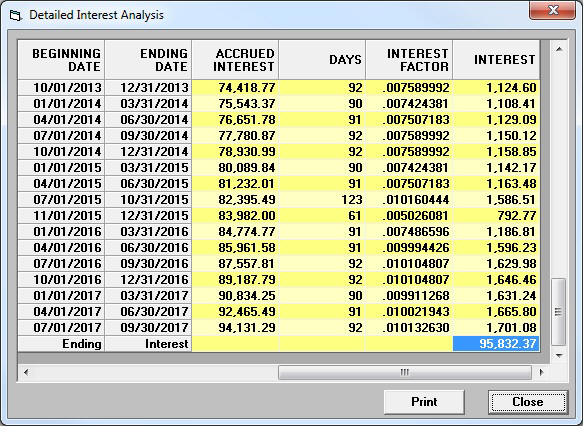

Effective tax rate 172. In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on. Free Online Sales Tax Calculator for each State and Locality in the United States updated for 2022 includes State Sales Tax Rate tables information and online calculator.

Enter your filing status income deductions and credits and we will estimate your total taxes. The Deluxe package is 59 plus 49 per state. It offers a free version but it works with simple tax returns.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The VITA program offers free tax help to people who make 56000 or less persons with disabilities the elderly and taxpayers who speak limited English.

IRS tax forms. Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. 10 hours agoOverall TurboTax is an expensive product.

Ad Get the Latest Federal Tax Developments. Your household income location filing status and number of personal exemptions. The Connecticut Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

15 Tax Calculators. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. This tool uses the latest information provided by the IRS including changes due to tax.

Income tax rates in Malaysia range from 3 to 30 depending on your income bracket. The Federal or IRS Taxes Are Listed. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Console Irs Tax Calculator In Java Code Review Stack Exchange

2014 Federal Income Tax Forms Complete Sign Print Mail

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

How To Calculate Federal Income Tax

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Tax Calculator Estimate Your Income Tax For 2022 Free

Payroll Paycheck Calculator Wave

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Crypto Tax Calculator

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Income Tax Calculator Estimate Your Refund In Seconds For Free

5 031 Irs Tax Form Stock Photos Pictures Royalty Free Images Istock

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

What To Do If You Receive A Missing Tax Return Notice From The Irs